Understanding My Electric Bill

No one enjoys paying bills but they’re a fact of life. The only thing worse than having bills to pay is not understanding what you’re being billed for. As a company responsible for helping businesses manage their energy costs in deregulated states, it’s our mission to make understanding your electric bill simple. We want you to have all the facts so there are no surprises.

Electric bills in deregulated markets generally consist of three main components: supply, delivery, and taxes/other. We’ll cover what each component entails below.

Supply is the actual amount of electricity you use during the month

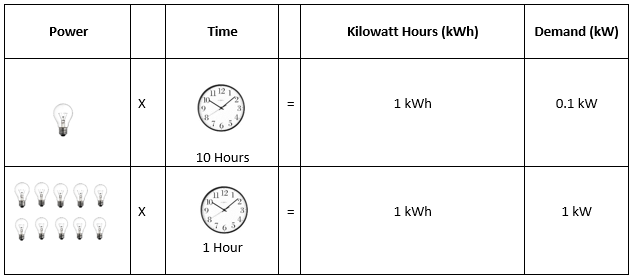

This is determined by how many kilowatt-hours you used, measured by your meter. A kilowatt kWh is 1,000 watts used in an hour. If you have ten 100-watt light bulbs on for an hour, you would use 1 kWh. The supply portion of the bill can range between 5-10 cents per kWh depending on your usage and area. Your local utility company does not make money on the supply portion of your bill so they do not care where you purchase your supply from.

Delivery is how the electricity/supply gets to you

This is where your local utility makes money. They own the lines and meters and charge you rent based on how much electricity you use during the month.

For accounts with demand meters, you pay based on the maximum amount of electricity you use during a specific period of time, generally an hour or less. Demand is also referred to as kW (kilowatt). Think of it as bandwidth.

The larger the pipe gets during the month the more expensive the delivery portion of your bill runs. If you turn on all your equipment at once, run it for only an hour (Con Edison measures the highest 30-minute period), and then close your facility for the rest of the month, you still will have to pay the same for the month even if you remained opened. If you allocate delivery over total kWh used during the month, it generally runs about 3-4 cents per month.

How your utility collects taxes for state and local municipality

Taxes and “other” is the portion of the bill where your local utility collects taxes for the state and local municipality. This section may also include other mandated collections for programs, such as energy efficiency rebates. Taxes generally add about .5-1.5 cents per kWh.

Overall, this means that depending on your area and usage, your total cost per kWh should be between 9-15 cents per kWh.

Our job is to make sure your business is getting the best deal possible on your electricity rates. This is why we research and offer competitive bids, and we do that by examining your most recent bills to analyze areas where you could potentially save. In fact, we’ll walk you through the entire process, introduce you to the suppliers we represent, and give you the information you need to make an informed and fiscally sound decision.

If your business is interested in finding a partner to help manage its energy needs, we can be your single point of contact, work with you to meet your company’s clean energy goal and provide you with a detailed budget report. We’ll keep things running smoothly for you. Contact us today to get started!